Overview¶

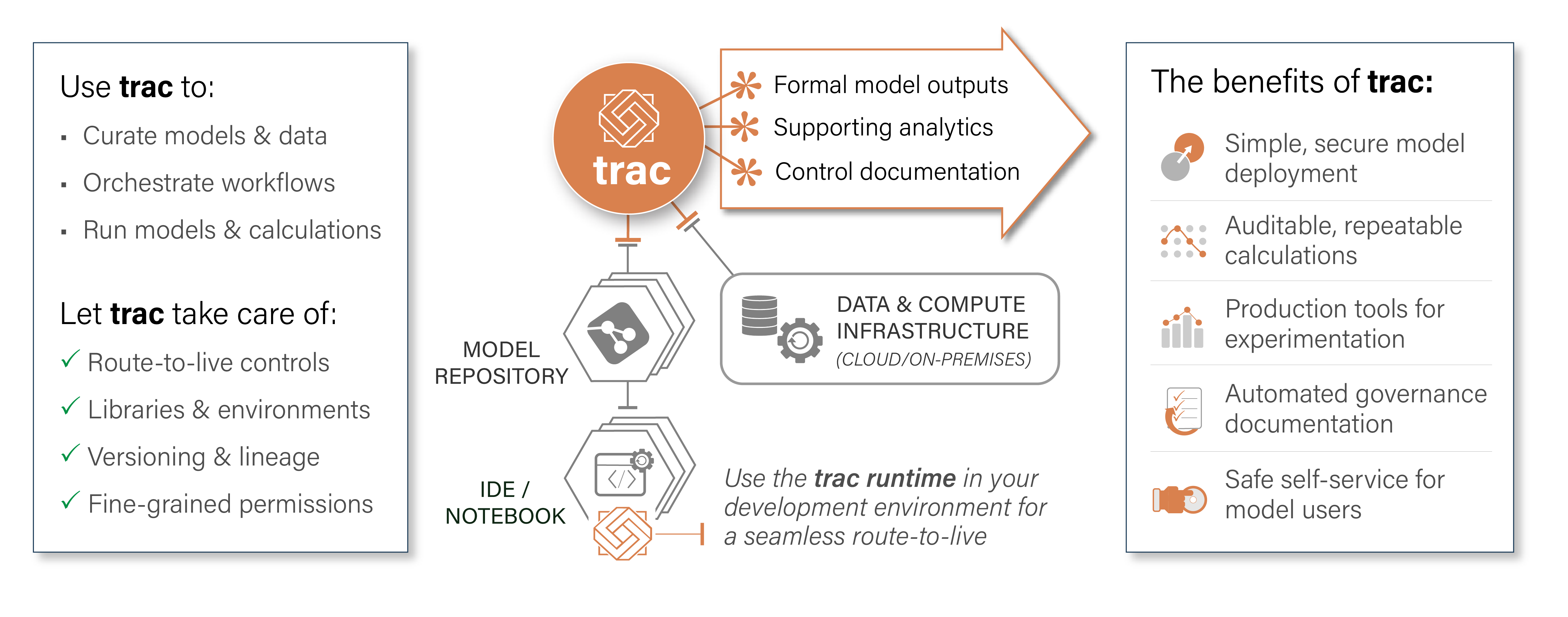

Trac integrates your data and compute infrastructure, code repositories and development tools to create a unified environment in which to build, deploy and use models. The result — stronger controls, richer analytics and lower cost — across the model lifecycle.

Note

This short video provides a quick overview of trac and how to use it.

Model orchestration¶

Integrate your data and compute infrastructure, model development tools, and code repositories and create a unified ecosystem in which to build, deploy, and use models.

In this ecosystem, use trac to:

Curate models and data

Orchestrate analytic workflows

Execute calculations

Adding trac to your enterprise data & analytics toolkit therefore gives you:

A simple, secure process to deploy models to production

Auditable and repeatable calculation processes

Powerful built-in tools for experimentation and analytics

Automated governance-ready documentation

A safe, self-service environment for model users — with zero change risk

Structural analytics¶

Structural analytics means any analytic process with a defined structure that needs to be run in a controlled, transparent, and repeatable way. Trac is purpose-built for these use cases, particularly the high-impact models that support accounting, regulatory calculations, and disclosures.

IFRS9 impairment calculations

Risk-weighted asset (RWA) calculations

Stress testing & scenario analysis

Financed emissions and climate risk

Customer-level risk metrics

Liquidity reporting

Model monitoring and validation

Note

The platform is unopinionated and can run any type of model or calculation — this is just a list of example banking use-cases that particularly benefit from trac’s design.